Focused on Taxation

EXPERTISE

Taxation

As a former senior manager in tax at one of Canada’s BIG 4 firms and a tax auditor with the Canada Revenue Agency in Victoria, I have lots of knowledge and experience when it comes to tax.

Just as important though, I have a good understanding of small business. While I have worked with some of Canada’s largest businesses – not to mention the occasional unicorn (at last count there were only 17 in all of Canada), I particularly enjoy working with small business.

SR&ED

Canada’s Scientific Research & Experimental Development tax incentive is a kind of secret sauce that helps small Canadian tech companies compete with the best in the world. Over the years I’ve had the opportunity to help innovative Canadian companies recover millions in tax incentives. It begins with an excellent understanding of eligibility (check out my videos on eligibility). It also requires that claimants know what kind of supporting documentation exists – and how to build valid claims.

PUBLICATIONS

Corporals of Industry: Exploring the Unholy Alliance between the Education Industry and the Professions (2022)

The author attempts to sequence the genetic code of the contemporary university from the Medieval guilds of masters and students through the 20th and 21st centuries. He looks at the proliferation of professions beginning in the 20th century and how these resemble the same Medieval guilds.

Canada boasts among the highest levels of post-secondary education in the world, yet our productivity lags behind that of most other Western economies. We examine the supposed link between higher education and productivity, which justifies our continued investment.

We look most deeply at the accounting profession and business schools, which are particularly popular among students, and consider the marketing efforts by universities to international students. These days Canadian universities rely very heavily on international students, who pay 5.28 times the tuition of Canadian residents. This has spawned an ‘immigration consultant’ industry supported by universities that pay finder’s fees for international students.

At the same time, the largest and most influential CPA firms have re-engineered competency requirements so that smaller firms can no longer train replacement staff. This results in increasing consolidation within the profession.

Median wages reported by our professional bodies are overstated by 80% or more, making employment with the largest firms seem more attractive than it is. All of which seems like an egregious breach of the ethical requirements of a profession supposedly committed to accurate financial reporting.

WHERE ANGELS FEAR TO TREAD (2013)

An overview of the angel investing ecosystem, documenting common methodologies angels use to value startups.

SR&ED UPDATE (2008)

In 2008 Rob wrote and presented a SR&ED Update to the Canada Tax Foundation in Winnipeg. The report was reviewed by Mel Machado – former head of CRA’s SR&ED Directorate – and a partner with PwC in Ottawa

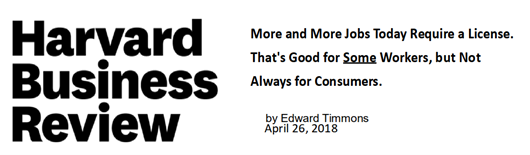

Taking A Stand Against Self-Serving

& Unethical Regulators

It is with a little sadness that I gave my lawyer instructions earlier today to restructure my accounting services corporation. I did this in preparation for my withdrawal from membership in CPA Canada and CPA British Columbia.

More than a quarter of a century after qualifying as a ‘professional’ accountant, I finally came to the inescapable conclusion that my profession does not serve the needs of its ordinary members, their clients or even the public at large. This is true despite what the profession tells anyone who will listen about the importance of professional regulation to protect the public interest.

This situation is not unique to my profession. It is not even unique to this country.

May 20, 2023

“In the 1950s, approximately 5% of U.S. workers had an occupational license, meaning they completed additional schooling or training (and paid the necessary fees) and passed an exam to be licensed to practice the profession in a certain state. Today, the Bureau of Labor Statistics estimates that 23% of full-time workers have a license.

This uptick in licensed workers is the direct result of the growth of occupational licensing laws. In the early 1990s, 800 occupations required licenses in at least one state. In 2016, that number increased to approximately 1,100 occupations.

Critics of licensing…note that professional associations lobby for occupational licensing out of self-interest, to restrict competition and increase earnings. They say that, instead of serving the public good, licensing harms consumers by restricting access to professional services.

When testing these theories, researchers have found evidence of the costs of occupational licensing on workers and consumers. For example, a report published by the Obama White House in July 2015 highlighted certain costs, such as higher prices for consumers and fewer job opportunities for aspiring workers.”

Focused on taxation

& doing it differently

…in 2012 I left one of Canada’s largest CPA firms where I had worked as a senior manager

in their Scientific Research & Experimental Development (aka “SR&ED” or “SHRED”) tax practice…

I wanted to do tax differently…

February 2022

My experimentation with cloud-based technologies and remote teams, beginning in 2012 seems to have given me a head start responding to the COVID 19 pandemic. However it wasn’t because I had some kind of special ability to predict the future. Instead I’d found that the cost of real estate in Vancouver and demographic changes generally would make staffing next to impossible for a small firm…

So I did what many global technology companies did. I added university graduates from the Philippines to my team. That helped me develop the infrastructure and the tools for working and collaborating remotely.

However profitable small firms typically don’t have staff.

At the end of the day I was successful mostly in developing training and tools for accounting technicians. The odds are stacked against small firms in our profession, where the leadership is focused on consolidation. In 2019 the largest 10 firms account for between 46% and 47% of public accounting revenue for the more than 18,000 accounting firms in this country.

Advisory Areas

Money and Finance

Focused on small business, we help our clients use statistics and standard forecasting techniques to project future results. We also help our clients understand rudimentary finance in order to explore early stage finance and funding sources for growing companies.

Agile IT

The quality of information technology is increasing faster than most of us can keep up. Small firms simply don’t have the resources to maintain a dedicated IT group. So we embrace a simple approach, that focuses on outsourcing as much as possible to high quality vendors and relying on SAAS (software as a service) and cloud-based subscription models.

Design and Strategy

Marketing, design, and business strategy are essential to effective management. Business strategy always starts with defining who your customers are. Our approach is geared to smaller businesses who don’t (or shouldn’t) start out trying to build a global or national brand. For a small business, a targeted approach is key.

Headquarters

2701 Galley Crescent

Pender Island

BC V0N 2M2

eMail: rob.farrow@robfarrow.net

Phone: (604) 256-2689

Mobile: (604) 992-3420